Your Essential Guide to Business Funding

Finance & Funding

Finance and funding are likely to be top of mind whether you’re a start-up creating your first business plan, or more established and planning for business resilience or growth. You’ll find everything you need here in our guide to help you navigate your best finance and funding options, get the support you need, and succeed in addressing challenges or scoping opportunities.

Finding and securing money is critical for your business to start, survive and thrive. From mitigating risks such as short-term cash flow issues caused by late payments or rising inflation, to maximising opportunities for growth, greening your business or going international, you want to know your options.

If you’d like us to make finding the right finance and funding easy, speak to our Business Funding Advisers. Visit our Get Funding website for more information.

Before you start, there can be a lot of jargon in finance and funding, so check out our handy finance glossary for more information on anything referenced.

This article is for general informational purposes and shouldn’t be considered as financial advice or recommendations for your business. You should seek professional advice for your business’s specific circumstances from an accountant, business funding adviser or insolvency service if required.

1

What are the options to fund my business?

Most business finance and funding falls into one of three categories: Grant, debt or equity.

Grants

Grant funding usually doesn’t have to be paid back and must be used for the purpose you agreed in your application. Typically, grants will be available to help improve your business in some way, or try something new to help de-risk a project. They don’t tend to be available to cover day-to-day trading expenses.

You’ll need to keep detailed records and monitor the outputs such as jobs created or protected, number of units sold, revenue made, and so on.

While it can be challenging to find and successfully apply for grants, they are worth the effort. They can de-risk growth and innovation projects, help you adopt new technology, and become more sustainable.

For tips on how to structure your grant application successfully, watch the video below, where Phil covers:

-

- What a business grant is.

- How to do your research.

- Getting your business documentation “grant ready”.

- Writing your grant application.

- Setting out your plans if you’re successful.

- Aligning your financials.

- Proofing and hitting the deadlines.

How do I find eligible grants?:

-

- Search for available grants.

- Get support to apply for a grant you’ve found.

- Speak to our UMi Get Funding Business Funding Advisers, who can help look at the whole funding market available to you.

Debt Finance

Debt finance can be arranged through banks and other lenders – sometimes called alternative finance. It may be short-term for seeing your business through a tough time, or for a large capital investment such as new machinery. You’ll need to be clear on how much you need and how you will pay it back.

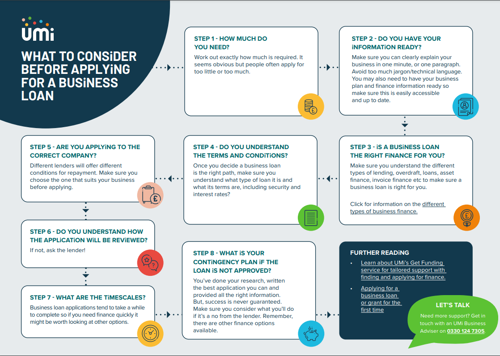

Click the image below to download a PDF copy of our overview of what you need to consider before applying for a business loan.

Lenders will need to see a business plan and financial forecast no matter what your stage of business. You can build good relationships and a solid credit record, but they will still need to assess every loan individually to ensure you will be able to pay the loan back.

Within their assessment, they will be looking for affordability to pay back the loan plus any interest, and at your assets if the loan is secured against them.

The exception is when you have been approved for credit such as an overdraft or credit card with a bank, or you have arranged trade credit with a supplier. Any checks would be done on application, then you have an agreed credit limit available, which is subject to change.

For an overview of debt financing and to find out what kinds of businesses should be taking this funding route, watch the video below, where Glen covers:

-

- What a business loan is.

- Why stage of business is important when applying for a loan.

- Asset and invoice financing.

- Secured vs unsecured loans.

- Why honesty and transparency are key when speaking to lenders.

- Why shopping around for the best deal might not be a bad thing.

How do I find finance options?:

-

- Find out more about debt finance.

- Look for a lender.

- Get support to find and apply for a loan.

Equity Investment

Equity investment exchanges shares in your business for a financial investment. The funding might come from an individual such as an angel investor, or from several people in the case of equity crowdfunding and investment funds.

You’ll need to have solid evidence of market demand and scalability, as well as knowing how much you want to raise and how it will be used.

Investors will expect a compelling and rigorous pitch. This will be based on your business plan, but it also needs a strong element of persuasion. Why should they risk their money on your business? What return can they expect and when? Why you?

In return, you’ll be looking for investors who align well with your values and can offer connections and expertise in addition to funding.

Fundamental questions you need to answer before you start...

-

- Have you considered all sources of funding?

- Are you raising the right amount from the right people, at the right time, at the right valuation?

- Do you have the correct legal structure?

- Are you eligible for UK tax relief under the Enterprise Investment Scheme?

- Are you aware of the obligations of having external investors?

- Have you got, or will you work towards getting, an independent board?

- Have you prepared balanced financial projections?

- Have you kept the investment structure simple?

- Are you prepared to provide full disclosures?

- Is your valuation reasonable?

- Is your fundraising spread sensible?

- Do you know how you will spend the investment?

- What are the most likely exit routes?

- Do you have enough cash to raise cash?

To answer these questions, refer to our fundamentals of raising equity article.

Get pitch ready

Once you’ve done research on your potential investors to determine which one is right for you, it’s time to show the potential investors your confidence in your business. Be yourself and trust in your business.

Here are some quick steps to get pitch ready:

-

- Give yourself plenty of time to do it

- Use your own money first

- Have a plan

- Get the best team in place

- Research investors thoroughly

- Decide what sort of deal can you offer an investor

- Understand how much money you really need

- Practice your pitch

If you need help to get your pitch in top shape, check out our article on the simple ways to prepare your business for investors.

How do I find investors?:

-

- Find out more about equity funding.

- Look for funders.

- Get support to find and apply for investment.

If you want to delve deeper, read more about the difference between the different types of business finance.

2

How do I know which type of finance or funding is right for my business?

How you fund your business will depend on:

-

- The stage you’re at

- What the money is for

- The circumstances you’re in

- Your ambitions

- The kind of trade-offs you’re willing and able to make

There are some questions to ask yourself that will help you to determine which kinds of funding might be right for your business. It may be a mix of types, and it’s worth speaking with a funding adviser who will have the experience and expertise to help you find the optimum blend.

To start exploring your options, answer the following questions:

-

- Do you have an appetite to scale and exit your business in the next five to 10 years?

- Would you be comfortable allowing other people to have a say in your business?

- Does your business structure allow you to issue shares?

- Do you need money urgently?

- Does your business have a good credit rating?

- Do you need the money to meet day-to-day business expenses?

- Is the money to be used for a specific project eg new machinery, expanding production, larger premises, improved sustainability?

- Would the results of the project have wider benefits for your community, eg employment, supply chain opportunities, attracting more visitors or businesses to the area?

- Could you part-fund the project from internal sources of finance?

Equity funding would be worth considering if you answered yes to questions one to three. Some business types won’t be suitable for equity, for example if you are a company limited by guarantee, if you want to stay small, grow slowly or retain full control.

Loan finance would be best if you answered yes to questions four to six. Equity or grant funding will not be suitable if you need money quickly, and grant funding is usually not available to support day-to-day trading costs.

Grant funding may be available if you answered yes to questions seven to nine.

The world of business finance and funding can be confusing, with the huge range of options and terms & conditions on offer. It’s also ever-changing, with products emerging to meet the needs of a changing business landscape. If you are not sure where to start with your options, or you need help finding funding you are eligible for, UMi Get Funding advisors can support you with tailored advice that’s right for your business.

You can also get inspiration, insights and advice from other businesses that have secured finance and funding.

3

How do I prepare my business for funding or finance?

For all kinds of funding and finance, there are some common areas of your business that you can assess and strengthen where needed, to put you in the best position to make a successful application.

It’s worth taking stock of the following before you have any conversations about funding and finance:

-

- Market research – how strong is your evidence of market demand and your product-market fit?

- Financial planning – do you have realistic financial forecasts for the next three-to-five years that are based on sound data or reasonable estimates?

- Protections – are you protecting your intellectual property, do you have robust legal documentation, strong processes and insurance?

- Talent – have you got the skills, knowledge and experience you need? If you haven’t, do you know what gaps you need to fill?

These elements are the minimum that a lender, funder or investor will look at for their due diligence. While you look over each of these, ask yourself from their perspective, would it be attractive to put money into my business based on our current position? If the answer is no, what do you need to strengthen?

Our essential guides are designed to meet you where you are, working from strategic foundations to tactical implementation. You can use them to check your progress and as a guide to your next steps, ensuring you have a solid platform on which to build.

Check out our other essential guides:

- Starting a business

- Marketing, sales and customer experience

- Reducing costs and improving cashflow

- Recruitment and people management

If you already have an accountant, legal advisor and other professional support, it’s worth scheduling a check-in with them. They can give you tailored advice based on their knowledge of your business. This will also give them an early heads-up that you’re potentially going to want to draw on some more support from them through your funding journey.

4

How do I find finance or funding my business is eligible for?

The internet is awash with information about finance and funding for businesses and with AI integration now in search engines, you can find a lot of information quickly.

What is more difficult is knowing which opportunities your business is eligible for without having to wade through a sea of application criteria.

If you know which type of finance or funding you want to apply for, you can use dedicated finance comparison sites to narrow down your options. However, you’ll still need to check your eligibility for each one.

5

How can I make this easy?

You can also draw on the support of an UMi business funding advisor. They will have in-depth industry knowledge and experience of assessing your requirements, the options you are eligible for, and which you have the best chance of securing. This will allow you to optimise your time and energy and give you the highest level of confidence in going for your goals.